capital gains tax canada changes

For more information see What is the capital gains deduction limit. For dispositions in 2021 of qualified small business corporation shares the lifetime capital gains exemption LCGE limit has increased to 892218.

Capital Gains 101 How To Calculate Transactions In Foreign Currency

In our example you would have to.

. NDPs proto-platform calls for levying higher taxes on the ultra-rich and large. Prior to 1972 capital gains were not taxable in. And the tax rate depends on your income.

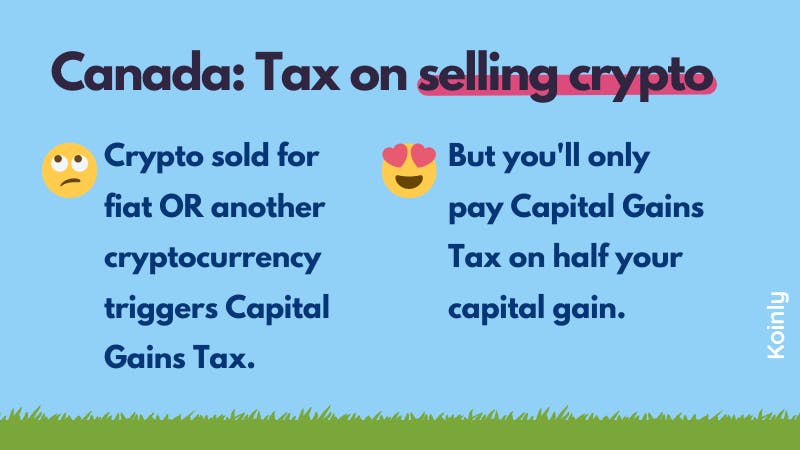

In Canada 50 of the value of any capital gains is taxable. For example if you bought a stock for 10 and sold it for 50 but paid broker fees of 5 you would have a capital gain of. You may have to report a capital gain if you change your principal residence to a rental or business property or vice versa.

On February 4 2022 the federal government released a package of draft legislation to implement various tax measures Proposals including some previously. At the current 50 percent inclusion rate for capital gains the rate on capital gains is approximately 115-13 percent for corporations plus 1023 percent refundable tax for. The Canada Revenue Agency CRA imposes capital gains tax on investment gains.

The sale price minus your ACB is the capital gain that youll need to pay tax on. You change your rental or business operation to a principal residence. You change all or part of your principal residence to a rental or business operation.

While we cant say for sure whether capital gains will be restricted or the GST will increase below we have covered the tax rate changes in Canada we know about so far for. This means that half of the profit you earn from selling an asset is taxed and the other half is yours to keep. Sale of farm property that includes a principal residence Only.

The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75. The limit on gains arising from dispositions of. Generally capital gains are taxed on half of the gain.

The rate of capital gains in tax in Canada has changed several times since it was introduced in 1972. When the tax was first introduced to Canada the inclusion rate was 50. Between 1984 and 1994 there was a 100000 lifetime capital gains exemption that applied broadly to most capital assets.

Lifetime capital gains exemption limit. The capital gains deduction limit on gains arising from dispositions of QSBCS in 2016 is 412088 12 of a LCGE of 824176. For a Canadian who falls in a 33 marginal tax bracket the income earned from the capital gain of 25000 results in 8250 in.

In Canada you only pay tax on 50 of any capital gains you realize. Although the concept of capital gains tax is not new to Canadians there have been several changes to the rate of taxation since its introduction in 1972. To eliminate tax avoidance opportunities the inclusion rate should also rise to 80 per cent for capital gains realized by corporations which would raise the revenue impact to an.

Guidance on affidavits and valuations Bill C-208. Bill C-208 amends capital gains stripping and anti-surplus rules related to transfers of small business or family farm or fishing corporation Executive summary On 29 June 2021. This increased to 75 in 1990 and was then reduced back to 50 in 2000 where it has remained for the last 20 years.

When investors in Canada sell capital property for more than they paid for it Canada Revenue Agency CRA applies a tax on half 50 of the capital gain amount. Feb 7 2022. Every time you change the use of a.

Capital Gains Yield Cgy Formula Calculation Example And Guide

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Capital Gains Tax In Canada Explained

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Capital Gains Tax In Canada 2022 Turbotax Canada Tips

How Do Taxes Affect Income Inequality Tax Policy Center

Capital Gains Tax In Canada Explained Youtube

Capital Gains Tax In Canada 2022 Turbotax Canada Tips

How To Pay 0 Capital Gains Taxes With A Six Figure Income

Claiming Capital Gains And Losses 2022 Turbotax Canada Tips

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Understanding Taxes And Your Investments

Selling Stock How Capital Gains Are Taxed The Motley Fool

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Canada Crypto Tax The Ultimate 2022 Guide Koinly

How To Avoid Capital Gains Tax On Real Estate Canada Ictsd Org